1. The Background.

The term “provider travel” covers invoiced (“claimed”) charges by the provider to the participant which cover the per-km non-labour (vehicle) and hourly time costs incurred during travel (“travel costs”), other than transport costs incurred during service provision (“activity-based transport”).

The relevant service items, their codes, and conditions for this are specified in the Pricing Arrangements and Price Limits (PAPL) and the Supports Catalogue which are both available at the NDIS Pricing Arrangements page.

The current PAPL as of writing, “2025-26 v1.1” states starting on P 21 under the heading of “Provider Travel”:

“Providers can only claim travel costs from a participant’s plan when delivering a support item if all the following conditions are met:

- The NDIS Pricing Arrangements and Price Limits indicates that providers can claim for Provider Travel for that support item; and

- The proposed charges for the activities comply with the NDIS Pricing Arrangements and Price Limits; and

- The activities are part of delivering a specific disability support item to that participant; and

- The primary support is delivered directly (face-to-face) to the participant; and

- The provider explains the activities to the participant, this includes why the activities represent the best use of the participant’s funds (that is, the provider explains the value of these activities to the participant); and

- The participant has agreed to the travel costs in advance (that is, the Agreement between the participant and provider should specify the travel costs that can be claimed); and

- The provider is required to pay the worker delivering the support for the time spent travelling because of the agreement under which the worker is employed; or the provider is a sole trader and is travelling from their usual place of work to or from the participant, or between participants (my emphasis).”

It is therefore understood that participants are free to agree to pay these travel charges in any service agreement (SA) or disagree as they see fit, just as with activity-based transport charges.

It is accepted that sole trader independent support workers (ISW) working directly with NDIS participants under an ABN are NDIS providers, whether registered with the NDIS or not.

2. The Controversy.

On various forums including Facebook groups which are dedicated to discussing NDIS service provision there is in my experience an often heated argument over the issue of ISW being able to invoice for travel from their home to participants and back. This argument overlooks the fact that participants are free to agree to this or otherwise, as previously stated, no matter the opinions around this.

The general negative opinions expressed on this topic relate to perceptions of provider greed, extracting maximum payment from the participant plan, combined with ISW charging the maximum allowed rates under the PAPL with various justifications for this. These hold that ISW in particular are not allowed (“can’t”) by the PAPL to invoice for this. There have been what look like creative interpretations of the PAPL wording supporting that negative view.

I have been able to examine the correspondence from the NDIA presented as evidence for these interpretations, one of which was fragmentary and needed collating over time for analysis in context. The two which I am aware of are presented below in chronological order:

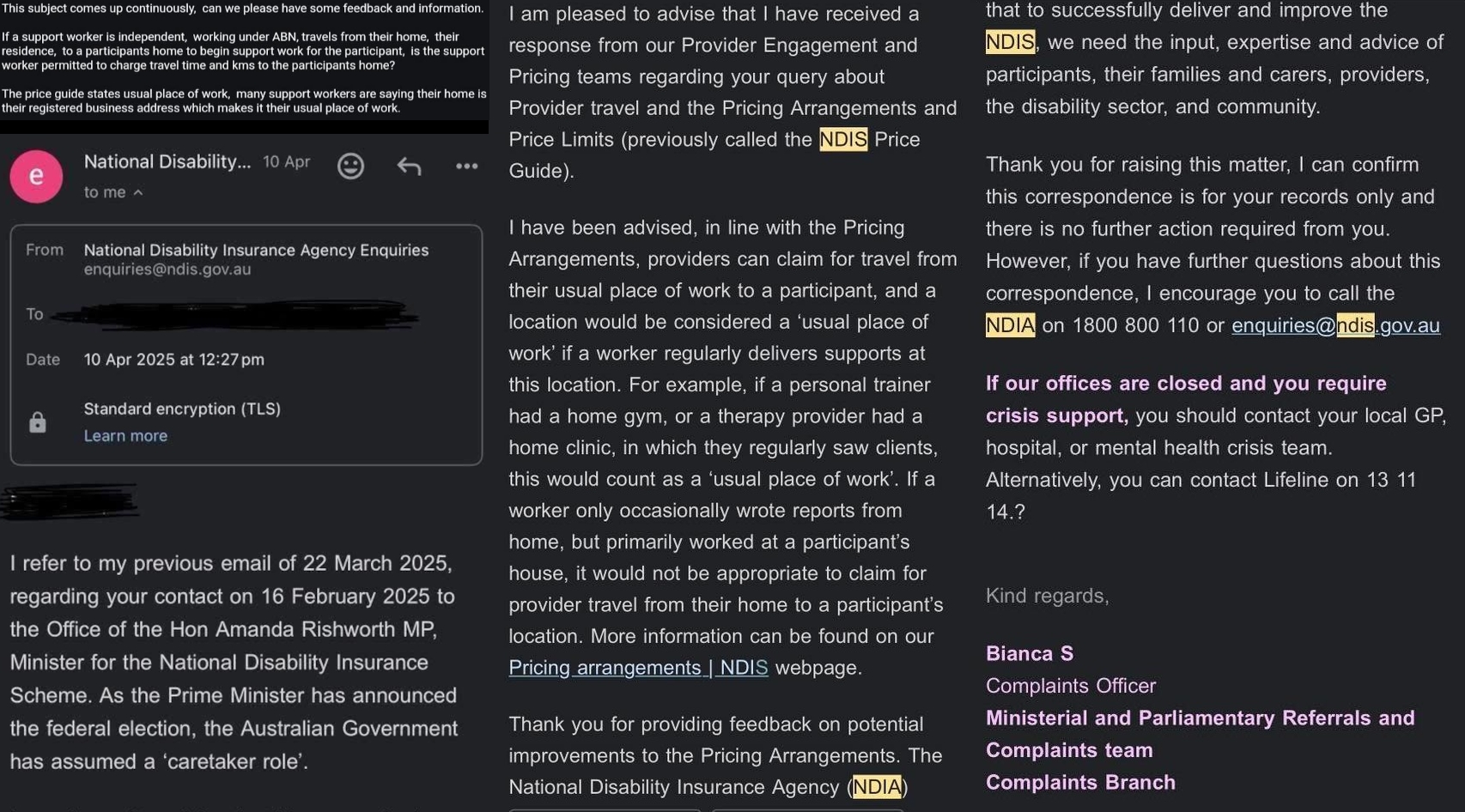

a) Dated 10/04/2025:

b) Dated 11/11/2025:

In contrast I have been given permission to share this correspondence which supports the opposite view:

c) Dated 04/02/2025:

1/3

2 /3

3/3

3. The Analysis.

It’s important to keep in mind the wording of the PAPL in the final condition “or the provider is a sole trader and is travelling from their usual place of work to or from the participant, or between participants.”

Logical analysis of this wording implies that the “usual place of work” cannot be the (location of) the participant, or between any participants. One has to wonder what this “usual place of work” (UPW) would be in an objective precise sense if not the interpretation provided by correspondence c, usually the address where the ISW’s business and ABN are registered with ASIC (“registered office address”), which is most likely their home address.

Both adverse correspondences a and b seem to be coming from authoritative sources, including the recently appointed acting CEO of the NDIS. These do have some problematic aspects to their formulation:

- Neither seem to address the specific issue of sole trader ISW. Instead, there are references to “support worker”.

- They show a very poor understanding of the work involved in running a disability provider business of any size, much beyond “writing a few reports”.

- Neither reference directly the wording of the PAPL with respect to sole traders much less ISW. Instead, they seem to take their cue from the wording and assumptions of the questions they each are responding to.

- They both seem to repeat the same cut-and-paste creative argument, which is also perhaps a reflection of the wording of the questions they answer but also may be from a template made for this purpose until the official definition of UPW is expanded on more comprehensively.

- This brings to question whether the acting CEO even read or responded to the question, or if this was handled by a subordinate according to some template as per the previous point.

The correspondence c which supports the ability of ISW to invoice these charges is much more comprehensive and specific in my understanding of the general rules of evidence, restating the question it is addressing, and referencing the wording of the PAPL accurately. Its conclusion is also much more in line with the PAPL wording, with no creative reasoning involved at any point.

This correspondence however is earlier than both the others and the argument has been made that it is superseded by these. The argument has also been made that it comes from a position of lesser authority (Markets Division) which is conflated with “Marketing Division”.

That argument to authority ignores the fact the person answering in this document was directly delegated by the Minister who overrides even the CEO, and the Markets Division is in fact the body within the NDIA which oversees the NDIS provider market, monitoring provider pricing and service provision nationally. The NDIA is not very transparent on this to my knowledge, but it can be assumed they at least inform the writing of the PAPL. That would explain the Minister’s choice in delegating her answer.

4. The Conclusion.

As a peer ISW who is both a participant and provider, I can understand the ethical problems for any provider to be charging for travel to and from the participant in any large urban area where providers and participants abound, and travel distances are typically short. One can even argue this is not reasonable and necessary. Participants are not likely to miss out on services if they refuse this.

There is the issue in regional, rural, and remote areas where this abundance is replaced by “drought” both of providers and participants in certain areas and require long travel for what are generally short shifts for in-home supports. These are known as “thin markets” which is what the Markets Division would be concerned with, and why the PAPL allows provider travel time charges of various maximum lengths depending on the MMM remoteness classification.

The fact these MMM-dependent charges are allowed would make no sense if this was only ‘between’ participants. There would also likely be considerable travel in this situation involved between the ISW’s UPW (home base) and the first participant, and back again from the last (if not the same). One can argue that the PAPL allowing providers of any kind including ISW to charge this is to preserve the sustainability of services in these areas.

In conclusion, while it may be unethical, unreasonable, and unnecessary in some geographical areas for ISW in particular to be invoicing participant plans for travel to and from their homes, it may be a necessary reality of service provision in other areas and why this is allowed in the first place. One would also expect in that case that the funding of plans in these areas would reflect that reality. It’s also crucial to remember that participants have the choice and control to reject these charges if they so wish.

It’s important to maintain an objective holistic view of this issue and not remain confined to narrow interpretations based on our own circumstances or limited experience, so that proper context is applied in these controversies. This may in fact lead to the realisation that the controversy itself is unnecessary.